When I first heard about Pepe Coin, I laughed. Not because it was bad, but because it felt unserious. Another meme. Another joke. Another promise of easy money dressed as internet humor. At that time, I didn’t feel the need to analyze it. I dismissed it the same way I dismissed dozens of meme tokens before it.

But markets have a way of humbling people who underestimate human behavior.

Over time, Pepe stopped acting like “just another joke.” It began behaving like something more dangerous and far more interesting: a social asset powered not by fundamentals, but by emotion, liquidity waves, and meme psychology. That was the moment I stopped ignoring it.

This is not a hype article. This is not a technical indicator prediction. This is my Pepe Coin outlook for 2026, built entirely on how people behave, why meme coins explode, why they collapse, and why some alarming patterns remain hidden even during strong price surges.

Why Pepe Is No Longer “Just a Joke” to Me

At first, Pepe felt disposable. Something people would trade, joke about, and forget. But after watching multiple market cycles, I noticed something important that most price focused traders miss. People were not buying Pepe because of technology. They were buying it because of identity.

Memes create tribes. Tribes create liquidity.

Pepe evolved into a symbol of risk-on behavior. When the market shifts from fear to fun, meme coins become emotional release valves. People don’t buy them to invest; they buy them to belong. That doesn’t make Pepe safe. It makes it powerful and dangerous at the same time.

This transition from joke to psychological instrument is exactly why Pepe still matters heading into 2026, even after extreme volatility and sharp corrections.

Why Timing Matters More Than “How High It Can Go”

Most people ask the wrong question when it comes to Pepe. They ask how high it can go. The smarter question is when Pepe becomes attractive to the crowd.

Meme coins do not move because of fundamentals. They move because attention arrives suddenly and leaves brutally. If you buy too early, you get bored and exit. If you buy too late, you become liquidity for others.

This is why price targets without context are meaningless. Liquidity enters and exits meme coins faster than most people can react. Many traders lose money even during price surges because they mistake excitement for opportunity.

Pepe rewards timing, not loyalty.

Retail Money, Smart Exits, and the Trap Most People Don’t See

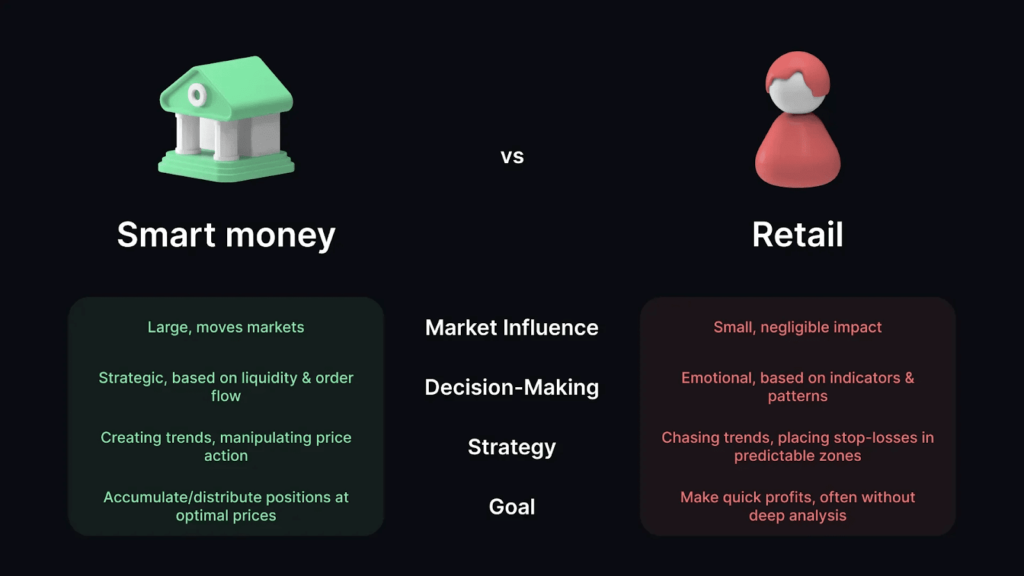

Here’s a harsh truth that experience teaches slowly. Retail money enters emotionally. Smart money exits quietly.

When Pepe starts trending on social media, retail enthusiasm peaks. But exits are often already being planned beneath the surface. This doesn’t mean Pepe cannot surge. It means surges frequently hide exit traps.

My personal risk filter is simple. When excitement feels universal, risk increases. When confidence feels absolute, upside shrinks. When nobody is asking who exits first, the danger zone is already active.

This pattern has repeated across every meme cycle I’ve observed.

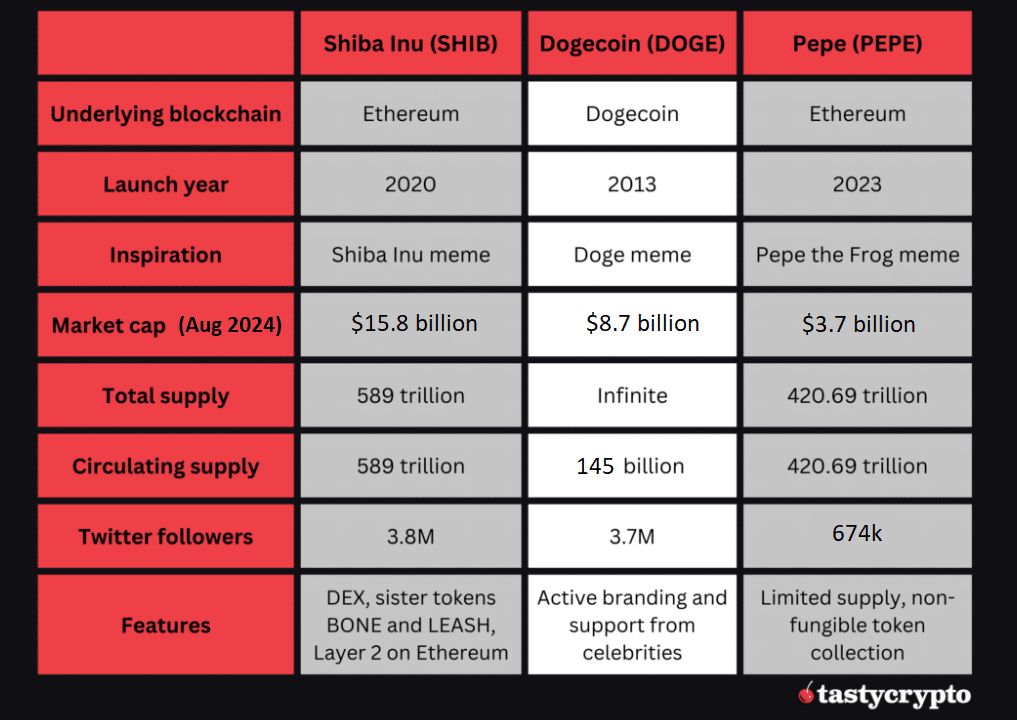

Pepe’s Supply Reality Check That Most People Ignore

Pepe’s token supply is massive, and this fact is often misunderstood. Many beginners assume a low price means cheap value. That’s not how markets work.

What actually matters is circulating supply and the market cap growth required for each price increase. Removing zeros becomes exponentially harder as supply grows. Pepe benefits from optical affordability. People see many zeros and feel early. But that same supply structure limits long-term price explosions.

This supply reality is critical when thinking about Pepe Coin price expectations for 2026 and beyond. Ignoring it leads to unrealistic assumptions and emotional decisions.

History Doesn’t Repeat, But Meme Cycles Rhyme

I don’t copy past meme coins, but I study their behavior closely. Different names, different communities, same emotions.

Explosive rallies arrive quickly. Distribution lasts longer than people expect. Long flat periods quietly kill attention. This rhythm has played out repeatedly across meme cycles.

This doesn’t mean Pepe cannot spike again. It suggests sustained growth is far more difficult than most traders believe.

The Three Most Realistic Pepe Coin Scenarios for 2026

Looking ahead to 2026, I see three behavior-based scenarios rather than predictions.

In a speculative revival scenario, liquidity returns aggressively and meme culture resurges. Pepe experiences sharp rallies driven by attention rather than conviction. These moves are fast and emotional, and late buyers often suffer.

In a sideways survival scenario, Pepe remains relevant but no longer dominant. Attention rotates elsewhere, leading to long consolidation phases and heavy opportunity cost.

In a hype exhaustion scenario, meme cycles move on entirely. Liquidity thins, volatility increases, and recoveries become slower and weaker.

None of these outcomes are guaranteed. They are probability frameworks based on how people behave.

The Price Levels I Personally Respect (Not Financial Advice)

I don’t rely heavily on indicators. I focus on psychological zones where human behavior shifts. These are areas where fear turns into hope, greed replaces logic, and volume changes character.

These zones matter more than moving averages because people react emotionally at them. This isn’t financial advice. It’s simply how I manage my own risk when dealing with speculative assets like Pepe.

A Simple and Honest Look at Pepe Price Behavior

Pepe’s price behavior follows a familiar rhythm. Long periods of compression are followed by violent moves. Sharp spikes are followed by deep retracements. Elevated prices struggle to hold without fresh attention.

This pattern supports one uncomfortable truth. Pepe can surge again, but underlying risk never disappears, even when prices rise.

Why Most Pepe Buyers Lose Even When Price Goes Up

Most losses don’t happen because the asset is bad. They happen because decisions are emotional.

People enter late. They exit emotionally. They hold without a plan. Profit requires structure, not hope. Pepe rewards those who respect cycles, not those who fall in love with memes.

My Final Verdict: Would I Personally Hold Pepe Into 2026?

I don’t marry meme coins. I would only consider holding Pepe into 2026 if liquidity conditions support risk assets, meme culture remains active, and my position size stays intentionally small.

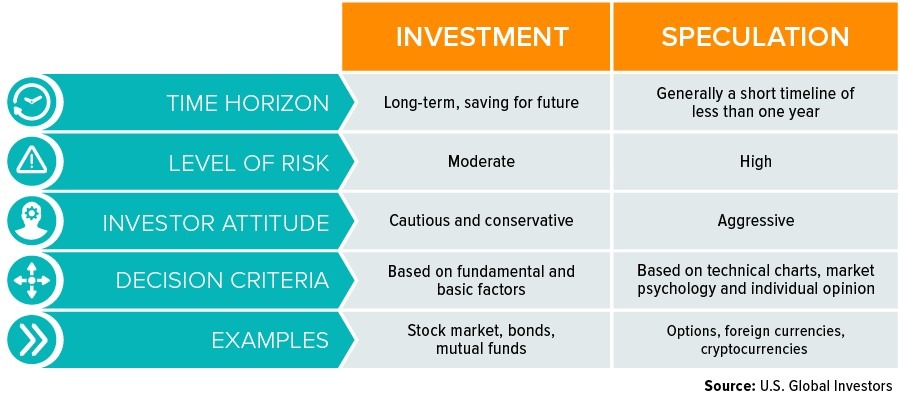

Pepe is a speculative opportunity, not a conviction investment.

Pepe Coin in 2026: An Opportunity, Not a Promise

Pepe may surprise people again. But surprises work both ways. If you treat Pepe like a lottery ticket, you’ll likely lose. If you treat it as a timing-based speculative trade, it can make sense.

That mindset defines my Pepe Coin outlook for 2026.

If you found this analysis helpful and want a complete crypto guide explained honestly and simply, tell me in the comments.