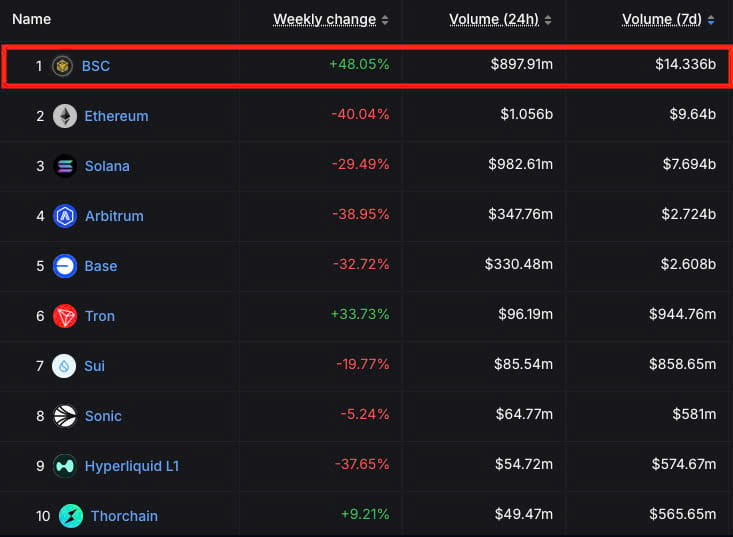

I didn’t choose BNB Chain because it was trendy.

I chose it because losing money repeatedly forced me to rethink everything I believed about meme coin trading.

In my early days, I chased meme coins on multiple chains. Some pumped. Most didn’t. What hurt wasn’t the bad picks it was watching profits disappear into gas fees, slow execution, and delayed exits. Over time, one pattern became impossible to ignore: the trades that survived friction almost always came from BNB Chain.

This article explains exactly why I shifted my meme coin trading to BNB Chain, what changed after that decision, and why heading into 2026 most consistently profitable meme coins still originate here. If you finish this guide, you won’t just understand BNB Chain better you’ll understand how meme coin markets actually behave.

I Lost Money Before Choosing BNB Chain (What Changed My Thinking)

Before BNB Chain, my meme coin trading looked exciting on paper but painful in reality. I would enter trades early, catch small pumps, and still walk away with disappointing results. The issue wasn’t timing or conviction it was friction.

Every transaction carried heavy costs. By the time I entered, paid fees, and exited, the market had already moved. Meme coins don’t wait. They rotate liquidity fast, and slow traders don’t get second chances. That realization changed my mindset completely.

I stopped asking which meme coin was “better” and started asking which chain lets me execute without bleeding capital. That question led me directly to BNB Chain.

Gas Fees Decide Who Survives Meme Coin Trading (BNB Chain Fixed This)

Gas fees are not a small inconvenience in meme trading they are the deciding factor between survival and slow death. On high fee chains, every trade must be perfect to justify the cost. Meme coins are rarely perfect.

When I compared execution costs, the difference was brutal. On some chains, I needed a significant price move just to break even. On BNB Chain, trades could breathe. I could enter earlier, test positions, and exit quickly without the market punishing me for participation.

That single factor transformed my strategy. Lower fees didn’t increase my wins they reduced my losses, which matters far more in volatile markets.

Speed Matters More Than “Good Projects” in Meme Coins

Here’s an uncomfortable truth most blogs avoid: meme coins rarely move because they are “good projects.” They move because liquidity flows fast, narratives change quickly, and attention shifts in minutes.

BNB Chain’s faster confirmation times allowed me to act inside these short windows. When momentum appeared, I could enter without hesitation. When sentiment flipped, I could exit without delay. That speed advantage matters more than whitepapers or roadmaps in meme markets.

Once I accepted that meme trading is a speed game, the chain choice stopped being philosophical and became practical.

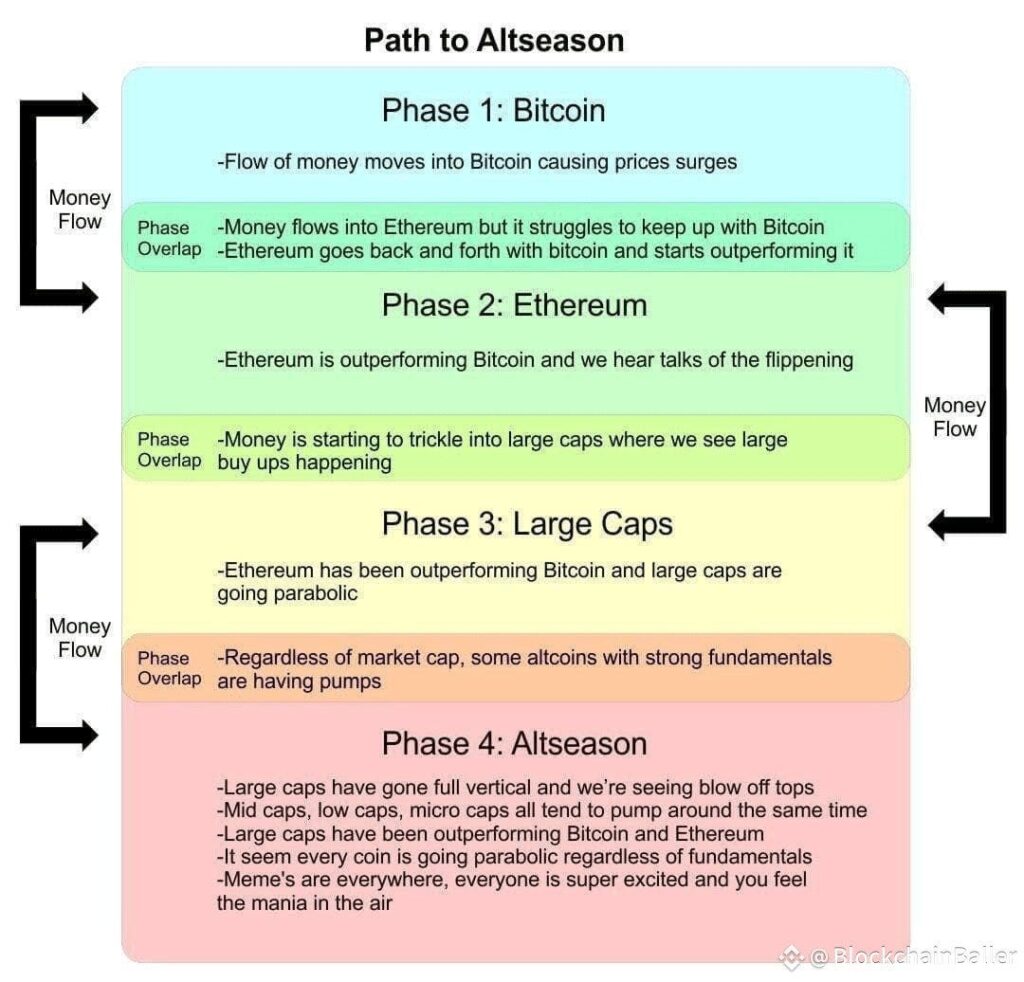

Liquidity Rotates to BNB Chain Before Most Traders Notice

After months of observation, a pattern became obvious. Many meme coins that later exploded elsewhere started gaining traction quietly on BNB Chain first. Early liquidity appears where friction is lowest.

Traders deploy capital faster when entry is cheap and execution is reliable. That early movement doesn’t show up on mainstream radar immediately, but it’s where asymmetric opportunities form.

BNB Chain often acts as the testing ground for meme narratives, and those who understand this dynamic position themselves ahead of broader market awareness.

Low Entry Barriers Create More Winners and More Losers

Low barriers are a double edged sword. BNB Chain makes launching meme coins easy, which fuels creativity—but also attracts bad actors. I’ve seen incredible gains and painful rugs on the same network.

This is where experience matters. Chain selection won’t protect you from poor risk management. Position sizing, entry discipline, and exit rules matter more than ever in fast moving ecosystems.

BNB Chain rewards those who respect risk. It punishes those who confuse speed with safety.

Meme Coin Culture Is Different on BNB Chain (And You Must Adapt)

Every blockchain has a culture. On BNB Chain, meme traders value momentum, execution, and fast rotation. Long ideological debates rarely matter. What matters is what’s moving now.

When I adjusted my expectations shorter holds, tighter exits, faster reactions my results improved. Fighting the culture of a chain is a mistake. Aligning with it is a strategy.

BNB Chain doesn’t reward patience the way other ecosystems might. It rewards awareness and adaptability.

Why Most “Surprise” Meme Winners in 2026 Launch on BNB Chain

As we move toward 2026, creators still prefer BNB Chain for one simple reason: lower risk at launch. Deploying contracts, seeding liquidity, and testing demand costs less here than almost anywhere else.

That creates more experimentation. More experimentation creates more unexpected winners. Many of tomorrow’s breakout memes won’t look impressive on day one but they’ll gain traction quickly where friction is low.

Being present where creation happens early remains one of the strongest edges in

The Hidden Risk Most Traders Ignore on BNB Chain

Speed amplifies everything gains and losses. The same environment that allows quick profits also enables brutal dumps. BNB Chain doesn’t forgive overconfidence.

I learned to control position size before chasing velocity. Capital protection became my priority. Without that discipline, speed turns from an advantage into a liability.

This is the risk most people miss: execution power without control is dangerous.

Why I Still Prefer BNB Chain (Despite the Risks)

BNB Chain is not perfect. It doesn’t eliminate risk. It doesn’t guarantee profits. What it does is align with the reality of meme coin trading.

It minimizes friction. It respects speed. It rewards preparation. For my style of trading—and for how meme markets behave it remains the most practical environment.

I don’t trade here because it’s easy. I trade here because it’s honest about what meme coins really are.

Final Verdict: What This Means for You

If you’re choosing a chain for meme coin trading, don’t ask which one sounds best. Ask which one helps you lose less when you’re wrong.

For me, that answer was BNB Chain.

If you want deeper, experience-driven crypto analysis without hype, without shortcuts—explore more guides on my blog. I focus on decision-making, risk control, and real market behavior, not promises.

Smart trading starts with understanding the environment you’re playing in.