The question on every crypto investor’s mind in 2026: Is Ethereum still worth your money? After years of technological upgrades, institutional adoption, and fierce competition from newer blockchains, Ethereum stands at a crossroads. This guide cuts through the hype to give you the facts, data, and honest analysis you need to make an informed decision.

Key Takeaways – Ethereum Investment Snapshot

Quick Overview for Busy Readers:

Ethereum remains the dominant smart contract platform with over 50% market share in decentralized applications and decentralized finance. The network processed over $27 trillion in stablecoin transactions annually and hosts more than $84 billion in total value locked across DeFi protocols.

Risk vs Reward Balance:

Ethereum offers high potential returns but comes with equally high volatility. Monthly price swings of 30-40% are common, with historical volatility averaging 38.34% compared to Bitcoin’s 23.23%. The risk-adjusted returns (Sharpe ratio) favor Bitcoin at 2.05 versus Ethereum’s 0.52, meaning you’re taking more risk per unit of return.

Who Should Consider ETH in 2026:

Consider Ethereum if you:

- Believe in the long-term vision of decentralized applications

- Can handle extreme volatility without panic selling

- Have a 5-10 year investment horizon

- Are willing to allocate only 5-10% of your portfolio to crypto

- Understand the technology and ecosystem

Avoid Ethereum if you:

- Need stable returns or can’t stomach 40%+ price drops

- Need your money within 2-3 years

- Are looking for guaranteed quick profits

What Is Ethereum and Why It Still Matters

Ethereum launched in 2015 with a revolutionary idea: create a programmable blockchain that could do more than just transfer digital currency. Unlike Bitcoin, which functions primarily as digital money, Ethereum was built as a decentralized platform enabling smart contracts self-executing agreements written in code that run without intermediaries.

This vision has materialized into real utility. Ethereum powers decentralized finance, enables digital ownership through NFTs, hosts stablecoins facilitating billions in transactions, and increasingly serves as infrastructure for tokenizing real-world assets. Over its history, Ethereum has survived multiple boom-and-bust cycles, completed a massive technological transition to proof-of-stake in 2022, and maintained its position as the second-largest cryptocurrency by market capitalization.

The network now operates with over 99% less energy consumption than before while providing passive income opportunities through staking, currently yielding 3-4% annually. With a fee-burning mechanism introduced through EIP-1559, Ethereum can become deflationary during high network activity more ETH gets destroyed than created, potentially creating long-term scarcity.

Real-World Use Cases Driving Value

Decentralized Finance (DeFi)

DeFi represents Ethereum’s most compelling use case. Of the $139.84 billion total value locked across all DeFi protocols, $84.01 billion (64.08%) sits on Ethereum-based applications. This includes lending platforms like Aave and Compound, decentralized exchanges like Uniswap, and yield farming protocols.

The significance goes beyond numbers. DeFi provides financial services to people without access to traditional banking, operates 24/7 without holidays, and offers transparency since all transactions are publicly visible on the blockchain.

Stablecoins and Payments

This might be Ethereum’s most underappreciated strength. The network hosts 156 stablecoins with a combined market cap of $135.52 billion, representing 55.52% of all stablecoins. Both USDT (Tether) and USDC (USD Coin), the two largest stablecoins, operate primarily on Ethereum.

These digital dollars enable fast, cheap cross-border payments and provide stable value storage in countries with high inflation. Stablecoin transaction volumes exceed $27 trillion annually. McKinsey forecasts daily transaction volumes could hit $250 billion within three years, potentially surpassing legacy payment volumes in less than a decade.

Tokenization of Real Assets

Major financial institutions are using Ethereum to tokenize real-world assets. BlackRock, Franklin Templeton, and VanEck have tokenized money market funds and U.S. Treasury bills on Ethereum’s network. The tokenization market grew from $10 billion in early 2024 to over $24 billion, with Ethereum holding 54.02% market share. Colin Butler, global head of institutional capital at Polygon, suggested this market has potential to reach $30 trillion.

Tokenization offers fractional ownership of expensive assets like real estate, faster settlement times for securities, 24/7 trading markets, and increased liquidity for traditionally illiquid assets.

Enterprise and NFT Applications

Real corporations are building on Ethereum. Companies use Ethereum smart contracts for supply chain management, property title transfers, and procurement systems. While NFT hype has cooled from 2021 peaks, the underlying technology enables genuine digital ownership beyond profile pictures—event tickets that can’t be counterfeited, digital identity systems, and proof of credentials.

Institutional Adoption and the ETF Effect

Institutional Investors Accumulating ETH

Institutional investors poured over $2.1 billion into Ethereum during peak buying periods in 2025, representing a significant shift from earlier skepticism. Hedge funds, family offices, and some pension funds now hold Ethereum as part of diversified portfolios. The institutional case focuses on Ethereum as infrastructure for programmable money and smart contracts, not just price appreciation.

Ethereum ETFs and Market Impact

The SEC approved Ethereum ETFs in 2024, enabling traditional investors to gain exposure through standard brokerage accounts. BlackRock’s iShares Ethereum Trust attracted $1.79 billion and became one of the fastest ETFs to surpass $10 billion in assets. Every major financial institution launched an Ethereum ETF, including Fidelity, VanEck, Franklin Templeton, and Invesco.

This institutional interest provides validation and potentially reduces volatility as long-term holders accumulate. However, a concerning trend emerged: despite having multiple ETFs, Ethereum’s cumulative ETF trading volume of $131.13 billion was notably exceeded by Solana’s single ETF volume of $475.34 billion, raising questions about institutional preference shifts.

Regulatory Progress

Cryptocurrency regulation is evolving rapidly. The European Union implemented comprehensive crypto regulations through MiCA. The United States has made progress on the GENIUS Act for stablecoins and the Clarity Act for digital assets. The SEC has not classified ETH as a security, and the approval of Ethereum ETFs implicitly validates this stance.

Regulatory progress in 2025 contributed to Ethereum’s 52.4% surge between July and August. However, clarity isn’t complete—DeFi applications face ongoing scrutiny, and evolving stablecoin rules create uncertainty.

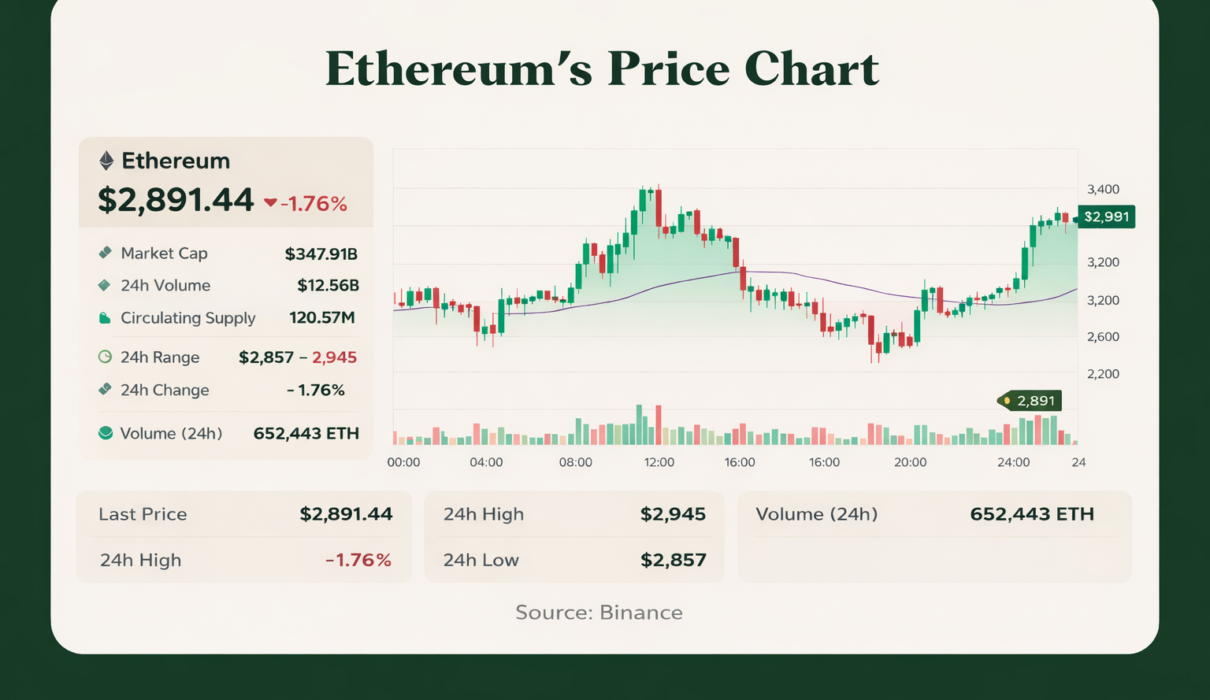

Price Performance and Market Data

Historical Performance

Ethereum’s price history shows extreme volatility with massive gains and painful crashes. From its 2015 launch around $1, Ethereum reached an all-time high of $4,954 in August 2024 a 135,500% increase over the decade.

The journey wasn’t smooth. Ethereum experienced an 80%+ crash in 2018, another significant decline in 2020, and a brutal bear market in 2022. Between July 8 and July 28, 2025, Ethereum surged 52.4%, crossing $3,700. Yet it still traded about 35% below its all-time high, illustrating both recovery potential and the long road back from bear markets.

Volatility Reality Check

Ethereum’s volatility dwarfs traditional assets. Over the past 12 months, Ethereum’s average monthly volatility reached 38.34% compared to Bitcoin’s 23.23%. Monthly price swings of 30-40% are normal, with some months seeing 60%+ moves.

This volatility creates opportunities for traders but challenges for long-term investors. Watching your investment drop 50% requires strong conviction and risk tolerance. Many investors sell at bottoms, locking in losses. Ethereum follows Bitcoin’s four-year market cycles loosely tied to halving events—bull markets typically last 12-18 months with exponential gains, followed by 1-2 year bear markets with 70-90% corrections.

Market Fundamentals

Ethereum maintains deep liquidity with daily trading volumes typically ranging from $10-40 billion. High liquidity enables large trades without significant price impact, making it suitable for institutional allocation. The significant percentage of staked ETH removes supply from circulation, reducing selling pressure and indicating long-term holder confidence.

Ethereum vs Bitcoin Which Is the Better Investment?

Technology and Purpose

Bitcoin functions primarily as digital gold a store of value designed to preserve wealth. Its technology is intentionally simple and conservative, prioritizing security and decentralization over features. Bitcoin’s investment case centers on scarcity (21 million maximum supply) and positioning as an alternative to gold and fiat currency.

Ethereum is programmable money and a platform for decentralized applications. Its technology enables smart contracts, DeFi, NFTs, and tokenization. Ethereum’s value comes from its usefulness, not just scarcity. As more applications build on Ethereum, demand for ETH increases for transaction fees and staking.

Risk-Adjusted Returns

The data tells a clear story: Bitcoin’s risk-adjusted returns (Sharpe ratio of 2.05) significantly exceed Ethereum’s (0.52), meaning Bitcoin delivered better returns per unit of risk taken. Bitcoin has established itself with regulatory clarity, institutional acceptance, and mainstream recognition. It’s still volatile but less so than Ethereum.

Ethereum faces greater competition, technological risk, and execution risk. Its upside potential might be higher if smart contracts transform industries, but so is the downside if competitors win or the technology fails to deliver.

Portfolio Allocation Perspective

Many crypto investors hold both, viewing them as complementary rather than competitive. A common approach allocates more to Bitcoin as the “safer” crypto, with smaller allocations to Ethereum and other alternatives.

A conservative crypto portfolio might be 70% Bitcoin, 20% Ethereum, 10% others. An aggressive portfolio might flip this, betting on Ethereum’s higher potential returns. Personal risk tolerance and conviction determine the right mix. Financial advisors typically recommend no more than 5-10% of total portfolio in cryptocurrency combined.

Risks of Investing in Ethereum

Competition From Other Blockchains

This represents Ethereum’s greatest existential threat. Solana, Cardano, Avalanche, Polkadot, and others offer lower fees, higher transaction throughput, and faster confirmation times.

Solana’s rise is particularly concerning. Its cumulative ETF trading volume of $475.34 billion far exceeded Ethereum ETFs’ $131.13 billion despite having only one ETF. Solana dominates blockchain gaming, attracts developers with better economics, and positions itself as the high-performance alternative.

While Ethereum’s total value locked market share was 51.7%, it decreased from 61.2% in February 2024. Meanwhile, Solana’s TVL dominance skyrocketed by 172% within the same timeframe. If this trend continues, Ethereum’s network effects could unravel.

High Gas Fees and Scalability Challenges

During periods of high demand, Ethereum’s transaction fees spike to $50-100+ per transaction, making small transactions economically unfeasible and pushing users toward competitors or Layer-2 solutions.

While Layer-2 networks like Arbitrum, Optimism, and Base offer fees 10-100 times cheaper, they fragment liquidity and complicate the user experience. If Ethereum can’t solve the fee problem at the base layer, users might permanently migrate to cheaper alternatives, undermining long-term value.

Smart Contract Security Risks

Smart contracts contain code, and code has bugs. Major DeFi hacks have cost users hundreds of millions of dollars. While Ethereum itself hasn’t been hacked, applications built on it regularly fall victim to exploits.

These security incidents damage trust in the ecosystem, result in user losses, and attract regulatory scrutiny. As more value locks into Ethereum-based applications, the incentive for hackers grows.

Regulatory Uncertainty

Despite positive developments, uncertainty remains. Governments could restrict stablecoin usage, require DeFi applications to implement KYC/AML controls, classify certain tokens as securities, or restrict cryptocurrency trading.

Regulatory crackdowns in major markets like the U.S., EU, or China could significantly impact Ethereum’s adoption and price. The decentralized nature provides some protection, but most users access crypto through centralized exchanges subject to regulation.

Macroeconomic Headwinds

Ethereum doesn’t exist in isolation. Cryptocurrency prices correlate strongly with global liquidity conditions. When central banks maintain low interest rates, risk assets including crypto tend to perform well. Rising rates make safe assets like Treasury bonds more attractive.

The Federal Reserve’s interest rate policy significantly influences crypto markets. Global recession, sustained high interest rates, stock market crashes, or geopolitical instability typically hit risk assets hard. Ethereum historically trades with high correlation to Bitcoin and moderate correlation to technology stocks, limiting diversification benefits.

Investment Strategies for 2026

Buy and Hold Strategy

The buy-and-hold approach means purchasing Ethereum and holding through market cycles regardless of volatility. This strategy worked exceptionally well historically—Ethereum is up 135,500% over the past decade.

However, past performance doesn’t guarantee future results. The days of 1,000x returns are likely over given Ethereum’s market cap. Realistic expectations are 3-8x returns over 5-10 years if fundamentals hold and adoption grows.

Buy-and-hold requires strong conviction, high risk tolerance, and the ability to ignore short-term price movements. It works best with capital you won’t need for many years.

Staking for Passive Income

Staking ETH generates passive income through validator rewards, currently yielding 3-4% annually. Benefits include earning returns on holdings, supporting network security, and potentially favorable tax treatment compared to trading.

Risks include staking lockup periods, smart contract risks if using staking services, and potential slashing if validators misbehave (usually not a concern for individual stakers using reputable services).

Dollar-Cost Averaging (DCA)

Dollar-cost averaging means investing fixed amounts at regular intervals regardless of price. This strategy removes emotion from investing, reduces timing risk, and takes advantage of volatility by buying more when prices are low.

For example, investing $100 in Ethereum every week ensures you don’t put all capital in at a market top. DCA works well for those building positions over time with earned income. The downside: If Ethereum trends strongly upward, you’re buying at progressively higher prices.

Trading vs Long-Term Investing

Active trading attempts to profit from Ethereum’s volatility by buying dips and selling rallies. This requires significant time, skill, emotional discipline, and often results in higher tax rates on short-term capital gains.

Most traders underperform simple buy-and-hold strategies after accounting for fees, taxes, and emotional mistakes. Long-term investing suits most people better: lower stress, better tax treatment, less time commitment, and historically better results.

Portfolio Diversification

Never put all your capital into Ethereum or any single asset. A diversified approach might include 60% Bitcoin, 30% Ethereum, 10% select altcoins, while maintaining most wealth in traditional assets like stocks, bonds, and real estate.

Diversification reduces risk of catastrophic loss if Ethereum fails while maintaining upside exposure if crypto succeeds.

Price Predictions and Future Outlook

Short-Term Scenarios (2026)

Short-term movements depend on macroeconomic conditions, regulatory developments, Bitcoin’s price action, and market sentiment.

Bullish scenario: Continued regulatory clarity, institutional buying, and successful network upgrades could push Ethereum toward $5,000-6,000 in 2026.

Bearish scenario: Macroeconomic headwinds, competitor gains, or negative regulatory developments could send Ethereum to $2,000-2,500.

Most likely: Continued volatility within the $2,500-4,500 range as the market digests recent gains and awaits clearer direction.

Long-Term Outlook (2026-2030)

Long-term predictions vary wildly. VanEck revised its 2030 price target from $22,000 down to $7,300, showing even bulls are tempering expectations. Ark Invest previously projected $166,000, though such estimates seem disconnected from realistic adoption curves.

A measured approach suggests 20% compound annual growth rate over the next decade is optimistic but possible if Ethereum maintains dominance. This would turn a $10,000 investment into roughly $60,000 by 2034—meaningful but not life-changing wealth.

Conservative estimate: $5,000-8,000 by 2030

Optimistic estimate: $10,000-15,000 by 2030

These assume continued adoption, successful scaling, and maintained market leadership.

Can Ethereum Reach $5,000 and Beyond?

Ethereum reaching $5,000 requires breaking through its previous all-time high of $4,954. This needs sustained institutional buying, positive regulatory environment, successful scaling solutions, and favorable macroeconomic conditions.

For Ethereum to reach $10,000 (roughly 3x from current levels), the entire crypto market would need significant growth, potentially requiring total crypto market cap to exceed $10 trillion. While possible over 5-10 years, investors should question whether 3x returns justify the volatility and risk when traditional diversified portfolios offer more consistent growth.

Bull vs Bear Case

Bullish case: Smart contracts transform industries, DeFi replaces segments of traditional finance, tokenization becomes standard, Ethereum maintains dominance, deflationary economics drive scarcity, institutional adoption accelerates, and regulatory clarity enables mainstream usage.

Bearish case: Competitors capture market share, high fees drive users away permanently, security breaches erode trust, regulations restrict key use cases, macroeconomic conditions remain unfavorable, or new technology makes blockchain obsolete.

Final Verdict: Is Ethereum a Good Investment in 2026?

Ethereum offers genuine utility backing its value—processing trillions in stablecoin transactions, hosting the majority of DeFi applications, and increasingly serving as infrastructure for tokenizing real-world assets. Institutional adoption through ETFs validates the asset class, and the deflationary mechanism could create long-term scarcity.

However, Ethereum faces serious challenges: fierce competition from faster, cheaper blockchains like Solana, persistent scalability issues despite Layer-2 solutions, significant volatility that exceeds Bitcoin, and regulatory uncertainty that could restrict key use cases.

The data shows Ethereum underperforms Bitcoin on risk-adjusted returns while facing greater execution risk. For most investors, Ethereum makes sense only as a small portfolio allocation (5-10% maximum) with a long-term horizon of 5-10 years.

Ethereum is a good investment if: You believe smart contracts will transform industries, can handle extreme volatility, have a diversified portfolio with most wealth in traditional assets, understand the risks thoroughly, and are prepared to hold through multiple market cycles.

Ethereum is not a good investment if: You need stable returns or short-term liquidity, can’t afford to lose your entire investment, are investing money you need for important goals, or are seeking guaranteed returns.

The honest answer: Ethereum could deliver substantial returns over the next decade, but it could also significantly underperform or fail entirely. Treat it as a high-risk speculation, not a core portfolio holding. Size your investment accordingly only allocate capital you can afford to lose completely.

Remember: This analysis is for informational purposes only and not financial advice. Cryptocurrency investments carry substantial risk. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

I want shorter version full ready blog like 1500 words to 2000 only I don’t want to much long blog so write shorter version on blog without losing the depth of this blog

16:43

Is Ethereum (ETH) a Good Investment in 2026? Complete Analysis and Outlook

The crypto landscape has transformed dramatically, and Ethereum stands at a critical juncture. After years of upgrades, institutional adoption, and fierce competition, investors are asking: Is Ethereum still worth your money? This guide delivers the facts and honest analysis you need to decide.

Key Takeaways What You Need to Know

The Bottom Line:

Ethereum remains the dominant smart contract platform with over 50% market share in decentralized finance. The network processed $27 trillion in stablecoin transactions annually and hosts $84 billion in total value locked across DeFi protocols. However, it faces mounting competition and significant volatility.

Risk Reality:

Monthly price swings of 30-40% are normal for Ethereum. Historical volatility averages 38.34% compared to Bitcoin’s 23.23%. The risk-adjusted returns favor Bitcoin (Sharpe ratio 2.05 vs Ethereum’s 0.52) meaning you’re taking substantially more risk per unit of return with ETH.

Who Should Invest:

Consider Ethereum only if you can handle extreme volatility, have a 5-10 year horizon, will allocate just 5-10% of your portfolio to crypto, and genuinely believe in decentralized applications. Avoid it if you need stable returns, can’t stomach 50%+ drawdowns, or need your money within 2-3 years.

Why Ethereum Still Matters in 2026

Ethereum launched in 2015 as a programmable blockchain enabling smart contracts self-executing agreements that run without intermediaries. Unlike Bitcoin, which serves primarily as digital gold, Ethereum functions as a decentralized platform for applications.

This vision has materialized into real utility: decentralized finance, digital ownership through NFTs, stablecoin infrastructure, and increasingly, tokenization of real-world assets. Ethereum completed its transition to proof-of-stake in 2022, reducing energy consumption by 99% while enabling staking yields of 3-4% annually.

The network’s fee-burning mechanism can make Ethereum deflationary during high activity more ETH gets destroyed than created, potentially creating long-term scarcity. This positions Ethereum uniquely between Bitcoin’s fixed supply and traditional inflationary currencies.

Real-World Use Cases Driving Value

Decentralized Finance Dominance

Of the $139.84 billion locked across all DeFi protocols, $84.01 billion (64%) sits on Ethereum. This includes lending platforms like Aave, decentralized exchanges like Uniswap, and yield farming protocols. DeFi provides financial services without banks lending, borrowing, and trading accessible 24/7 to anyone with internet access.

Stablecoin Infrastructure

Ethereum hosts 156 stablecoins worth $135.52 billion representing 55.52% of all stablecoins. Both USDT and USDC, the two largest stablecoins, operate primarily on Ethereum. These digital dollars facilitate fast cross-border payments and provide stable value storage.

The numbers are staggering: stablecoin transaction volumes exceed $27 trillion annually. McKinsey forecasts daily volumes could hit $250 billion within three years, potentially surpassing legacy payment systems within a decade.

Tokenization of Real Assets

Major institutions are tokenizing real-world assets on Ethereum. BlackRock, Franklin Templeton, and VanEck have tokenized money market funds and Treasury bills on the network. The tokenization market grew from $10 billion to over $24 billion, with Ethereum capturing 54% market share. Industry experts suggest this market could reach $30 trillion.

Tokenization enables fractional ownership of expensive assets, faster settlement, 24/7 trading, and increased liquidity for traditionally illiquid investments like real estate.

Institutional Adoption Accelerates

Institutional investors poured over $2.1 billion into Ethereum during peak 2025 buying periods. The SEC approved Ethereum ETFs in 2024, and BlackRock’s iShares Ethereum Trust attracted $1.79 billion, becoming one of the fastest ETFs to surpass $10 billion in assets.

However, a concerning trend emerged: Ethereum’s cumulative ETF trading volume of $131.13 billion was notably exceeded by Solana’s single ETF volume of $475.34 billion, suggesting institutional preferences may be shifting.

Regulatory progress contributed to Ethereum’s 52.4% surge between July and August 2025. The European Union implemented comprehensive crypto regulations through MiCA, while the U.S. advanced the GENIUS Act for stablecoins. The SEC has not classified ETH as a security the ETF approvals implicitly validate this stance.

Price Performance and Volatility

Ethereum has delivered extraordinary returns up 135,500% from its 2015 launch around $1 to its August 2024 all-time high of $4,954. But the journey included brutal drawdowns: 80%+ crashes in 2018 and 2022 that wiped out investors who bought near peaks.

Recent performance shows the ongoing volatility. Between July 8-28, 2025, Ethereum surged 52.4%, crossing $3,700. Yet it still trades about 35% below all-time highs, illustrating both recovery potential and the psychological challenge of bear markets.

Ethereum follows four-year cycles loosely tied to Bitcoin halvings 12-18 month bull markets with exponential gains, followed by 1-2 year bear markets with 70-90% corrections. Monthly swings of 30-40% are routine, with some months seeing 60%+ moves.

Ethereum vs Bitcoin: The Critical Comparison

Bitcoin functions as digital gold simple, secure, scarce (21 million maximum). Its investment case centers on monetary debasement hedge and non-correlated asset positioning.

Ethereum’s value comes from utility. As more applications build on Ethereum, demand for ETH increases for transaction fees and staking. But this creates complexity and more potential failure points.

The data favors Bitcoin: Risk-adjusted returns (Sharpe ratio) show Bitcoin at 2.05 versus Ethereum’s 0.52. Bitcoin delivered better returns per unit of risk taken, with lower volatility and broader institutional acceptance.

Portfolio approach: Many hold both as complementary assets. Conservative allocation: 70% Bitcoin, 20% Ethereum, 10% others. Aggressive: flip this ratio betting on Ethereum’s higher potential. Financial advisors typically recommend 5-10% total portfolio allocation to all crypto combined.

Critical Investment Risks

Competition Intensifying

Solana, Cardano, Avalanche, and others offer lower fees, higher speeds, and simpler onboarding. Solana’s rise is particularly threatening its ETF trading volume crushed Ethereum’s despite having only one fund. Solana dominates blockchain gaming and attracts developers with better economics.

Ethereum’s total value locked market share dropped from 61.2% to 51.7% since February 2024, while Solana’s surged 172%. If this trend continues, Ethereum’s network effects could unravel.

Scalability and Fee Problems

During high demand, Ethereum fees spike to $50-100+ per transaction, making small transactions economically unfeasible. While Layer-2 solutions offer 10-100x cheaper fees, they fragment liquidity and complicate user experience. If Ethereum can’t solve base layer fees, users may permanently migrate.

Security, Regulatory, and Macro Risks

Smart contract bugs have cost users hundreds of millions. While Ethereum itself hasn’t been hacked, applications built on it regularly suffer exploits, damaging ecosystem trust.

Regulatory uncertainty persists despite progress. Governments could restrict stablecoin usage, require DeFi KYC/AML controls, or classify tokens as securities. Macroeconomic conditions matter crypto correlates with risk assets. Rising interest rates, recession, or market crashes typically hammer cryptocurrency prices.

Investment Strategies That Work

Buy and Hold

Purchase Ethereum and hold through market cycles regardless of volatility. This worked historically (135,500% gains over a decade) but future returns will be far more modest. Realistic expectations: 3-8x over 5-10 years if fundamentals hold. Requires strong conviction and capital you won’t need for years.

Dollar-Cost Averaging

Invest fixed amounts regularly regardless of price. Removes emotion, reduces timing risk, and buys more when prices are low. Example: $100 weekly ensures you don’t dump everything at market tops. Works best for building positions with earned income.

Staking for Income

Generate 3-4% annual yields through staking while supporting network security. Benefits include passive income and potentially favorable tax treatment. Risks include lockup periods and smart contract vulnerabilities with staking services.

Diversification is Critical

Never put significant wealth into Ethereum alone. Recommended approach: 60% Bitcoin, 30% Ethereum, 10% select altcoins while keeping most wealth in traditional assets like stocks, bonds, and real estate. This reduces catastrophic loss risk while maintaining upside exposure.

Price Predictions and Outlook

Short-Term (2026)

Bullish case: Regulatory clarity, institutional buying, and successful upgrades push Ethereum toward $5,000-6,000.

Bearish case: Macro headwinds, competitor gains, or regulatory setbacks send ETH to $2,000-2,500.

Most likely: Continued volatility in the $2,500-4,500 range as markets digest recent gains.

Long-Term (2026-2030)

VanEck revised its 2030 target from $22,000 down to $7,300 even bulls are tempering expectations. A 20% compound annual growth rate is optimistic but possible if Ethereum maintains dominance.

Conservative estimate: $5,000-8,000 by 2030

Optimistic estimate: $10,000-15,000 by 2030

These assume continued adoption, successful scaling, and market leadership. For Ethereum to reach $10,000 (3x current levels), total crypto market cap likely needs to exceed $10 trillion.

Bull case: Smart contracts transform industries, DeFi replaces traditional finance segments, tokenization becomes standard, Ethereum maintains dominance, and deflationary economics drive scarcity.

Bear case: Competitors capture market share, high fees drive permanent user migration, security breaches erode trust, regulations restrict use cases, or new technology makes blockchain obsolete.

Final Verdict: Should You Invest?

Ethereum offers genuine utility processing trillions in transactions, hosting majority DeFi applications, and serving as infrastructure for asset tokenization. Institutional adoption validates the space, and deflationary mechanics could create scarcity.

But challenges are serious: fierce competition from faster blockchains, persistent scalability issues, volatility exceeding Bitcoin, and regulatory uncertainty. The data shows Ethereum underperforms Bitcoin on risk-adjusted returns while facing greater execution risk.

Ethereum makes sense if you:

- Believe smart contracts will transform industries

- Can handle extreme volatility without panic selling

- Have a diversified portfolio with most wealth in traditional assets

- Understand risks thoroughly and have a 5-10 year horizon

Avoid Ethereum if you:

- Need stable returns or short-term liquidity

- Can’t afford to lose your entire investment

- Are investing money needed for important goals

- Seek guaranteed returns

The honest answer: Ethereum could deliver substantial returns over the next decade, but it could also significantly underperform or fail. Treat it as high-risk speculation, not a core holding. Allocate only 5-10% of your portfolio maximum capital you can afford to lose completely.

The days of 1,000x returns are over. Realistic expectations are 3-8x over 5-10 years in optimistic scenarios. For most investors, a diversified approach weighted toward Bitcoin with smaller Ethereum allocation makes more sense than betting heavily on ETH alone.

This analysis is for informational purposes only and not financial advice. Cryptocurrency investments carry substantial risk. Conduct your own research and consult a qualified financial advisor before investing.